![]()

How to prepare for financial stress

Let’s face it, life is unpredictable.

When unexpected things crop up – whether it’s a job loss, home repair, relocation or a trip home to see a sick relative – you may be financially unprepared for it and this in turn may leave you feeling helpless, stressed and anxious.

You’re not alone. In fact, 31 per cent of Australians reported being under financial stress, meaning they had difficulty paying for essential goods and services.

And no wonder, as a country we’ve been through our fair share of things over the last few years. We’ve suffered with bush fires, flooding, have been through a pandemic and now there are inflation rises. It’s been a tough time for many.

If you’ve been left with a financial emergency, here are some things you can do to get back on your feet. What’s more, here are some steps to be prepared for next time…

1. Build up an emergency fund

Start saving now, as you’ll never know when you’ll need it. The best thing you can do is start saving before you need an emergency fund…

But chances are, if you’re reading this, you don’t have an emergency fund and need to access money right away. The good news is, it’s not too late!

The first step is to get rid of things you don’t need in your house. There could be some old plant pots, old clothes, old toys or furniture you don’t need anymore but others might like to buy from you. You could try selling these things on Facebook Marketplace or Gum Tree.

Additionally, you can temporarily take on extra work. Whether it be Air Tasker, Uber or maybe even ask your boss for extra hours for a short period of time.

2. Make a budget

Evaluate all of your expenses. How do you spend? Where can you save? Do you need all of those streaming devices? Can you consolidate any loans you have? You could always try making a list of essentials and extras.

Essentials are things like groceries and medical insurance. Extras tend to be things like your cleaner, if you have one, take away, nights out and things you can cut back on or stop doing altogether to save money.

3. Have things for a rainy day

The pandemic taught us to stock up on certain things and to make sure we had certain toiletries, first aid, medicine and cleaning products as well as basics in case of a last-minute lockdown (and we had quite a few of those).

Just because life has returned relatively back to normal, it doesn’t mean you have to stop doing what you were doing before. You don’t need to panic buy or hoard things, but it’s always a good idea to have some essentials at home in case of an emergency.

Maybe go through your pantry and cupboards to see what you have in there, you may be surprised! You might be able to get a few meals out of the food in your pantry to help save on your next grocery shop.

4. Get help

No one likes to ask for help, especially from family and friends, when it comes to finances. However, a little bit of borrowed money from a loved one might be able to help get you through a hard time, so it’s always good to ask. But if you can’t get help there, there are other options.

There may be charities that can also help you if you’re in a tight spot. You could also try heading into Centrelink to see if you can get assistance. Community centres or reaching out on neighbourhood support networks may also be another option.

Don’t try to work it out on your own, if you feel in over your head. It’s also important to get emotional support, as financial issues can cause a lot of stress. Speak to your GP and ask to be referred to a counsellor or a professional with whom you can speak with about how you are feeling.

5. Negotiate

Ask for an extension or a discount. Not all expenses need to be paid straight away, you may be able to pay back after a certain amount of time. Prioritise what is important and pay those off first.

If you’re having trouble with credit cards, overdrafts or bank loans, it’s always worth negotiating with the lender. One of the best things you can do, is to contact them ahead of your deadline and before you get behind on payments. You will be surprised how much they are willing to work with you.

Reaching out to a bank or mortgage company may also be worth your while, as they may be able to restructure your loan or tell you about a high interest bank accountant that may be able to help you.

6. Check your insurance

What insurance do you have, if you have any? There are different insurances out there to help you, such as health, car, homeowners, renters as well as disability insurance.

Each one has different coverage and while some you can’t start claiming back until a certain amount of time, it’s good to be across the different policies and assess whether it could help you in the future.

7. Learn to let go

There’s no point holding onto something that’s clearly out of your control. What ifs and hindsight are a beautiful thing but you can’t turn back time, unfortunately. The only thing you can take from this situation is to how to learn from it and how to make sure it doesn’t happen again.

A lot of the time, we can’t predict when we will need an emergency fund or what will happen in the future. Take the pandemic, for example, no one could’ve predicted it and a lot of people found themselves financially hard up, businesses were ruined and it was a tricky time for many.

But people did bounce back, and order slowly restored and it will also for you. Chin up, you’ll be back on your feet in no time.

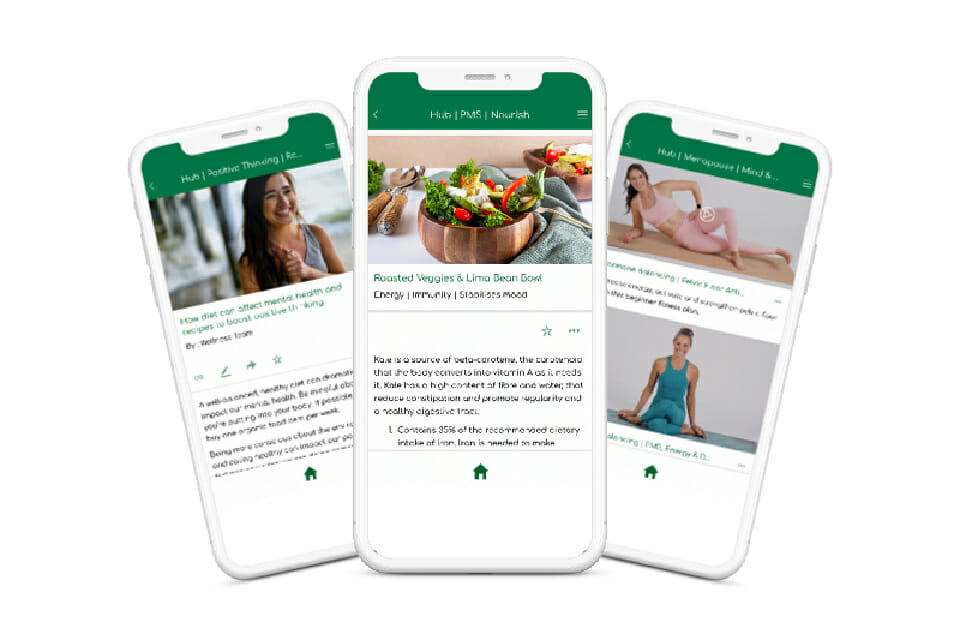

Learn to manage stress with The Healthy Mummy Wellness App

Healthy Mummy Wellness app is built to support mums’ mental, physical and social wellbeing. We have expert advice to help mums makeover their minds, transform their mood, manage their hormones, sleep better and engage with their family. You can listen to podcasts, read blogs, work out with our trainers and find healthy, family-friendly recipes from the palm of your hand.